- About Startup Genome and The Global Entrepreneurship Network

- About Our Global Partners

- Note From a Founder

- A Word from GEN

- State Of The Global Startup Economy

- Rankings 2021: Top 30 + Runners-up

- Rankings 2021: Top 100 Emerging Ecosystems

- Global Startup Sub-Sector Analysis

- The Next Unicorn Could Come From Anywhere

- How Startups Can Build Sustainable Ecosystems

- How To Divide Founder Equity

- Accelerators: To Join Or Not To Join?

- The Government As An (Effective) Venture Capitalist

- Building Entrepreneurial Communities

- Understanding Diverse Markets In A Dynamic Region

- Mega Tech IPOs Head Toward $1 Trillion By 2025

- Asia Insights, Rankings & Ecosystem Pages

- Europe’s Booming Startup Ecosystems

- The Explosive Growth Of The Amsterdam-Delta Startup Ecosystem

- Europe Insights, Rankings & Ecosystem Pages

- Entrepreneurial Growth In MENA

- Startup Culture on the Rise in Palestine

- MENA Insights, Rankings & Ecosystem Pages

- The North American Startup Ecosystem In A Post-Pandemic Era

- North America Insights, Rankings & Ecosystem Pages

Scaleups Will Take Over Latam

If you haven’t paid attention to Latin America’s startup and scaleup ecosystem then you are missing some remarkable developments. The last 5 years have been magical for the region, with dozens of new unicorns and unprecedented venture capital activity. And this is just the beginning. Startups and scaleups will take over Latin America, just as they have done in more mature markets. Their domination here may be even faster and more complete.

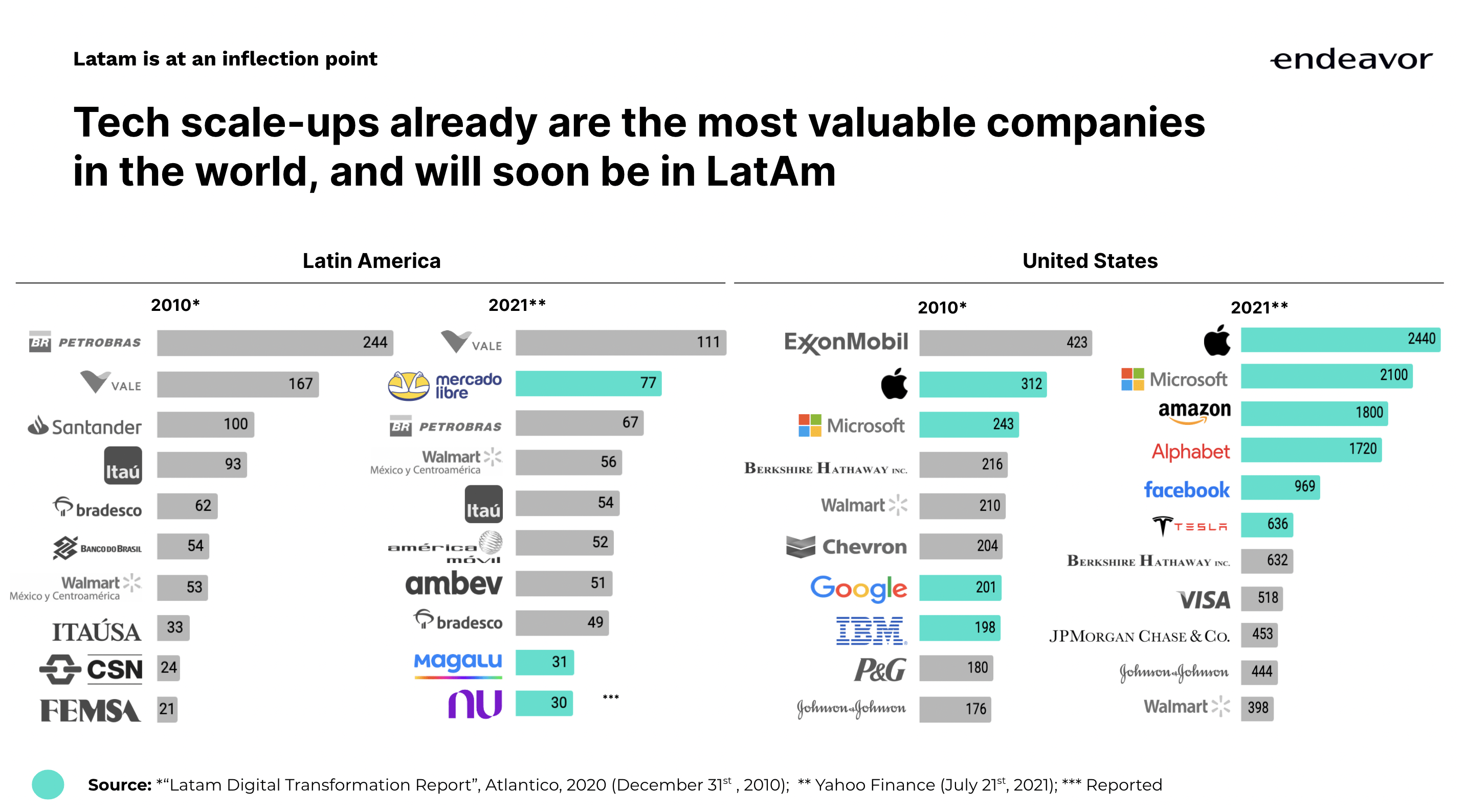

The United States and China have spawned tech companies that already are the most valuable in the world. As recently as 10 or 20 years ago, some of those companies did not exist. Latin America is starting to experience a similar trend, with Mercado Libre leading the way. The ecommerce giant is followed by tech companies like Magalu and Nubank, whose much-anticipated IPO might lead to a $100 billion market cap.

The same extraordinary progress is visible within individual countries. In Chile, for example, NotCo and Cornershop recently achieved unicorn status: the first two startups to do so. Both founded in 2015, they already are among the top 20 companies in Chile by market capitalization. Others--for example, Betterfly, Xepelin, and Fintual--will soon top the rankings. Brazil, Mexico, Argentina, Colombia, Uruguay, and Peru are all building strong ecosystems, with startups and scaleups reaching impressive marks. As happened elsewhere, the current generation of entrepreneurs will drive and expand these ecosystems, creating an enduring multiplier effect.

There is plenty of room for growth. Venture capital in Latam significantly lags its potential. Currently it is 14% the rate of the United States, proportional to GDP. But the market is huge (600 million people) and dominated by incumbents: great companies from the last century. Meanwhile, the rate of Internet adoption, especially among young people, is among the highest in the world. And Latin America now can claim those two words conservative investors look for: a track record. Four years ago there were no unicorns in Latam. Now there are more than 20, most backed by local and international investors.

We expect that in less than 5 years, at least 5 of the top 10 companies in Latin America will be tech startups, as is already true in the United States and China. The process in Latam will move even faster than in those countries. It took Apple 35 years to become the world’s most valuable company, in 2011. Mercado Libre achieved that status for Latam in less than 20 years. Brazil’s Nubank might surpass it in less than 10.

More than great companies, these startups and scaleups will solve tremendous problems in the region, from access to financial services to better health care and transportation. They will also create hundreds of thousands of high-paying jobs. The transformation is occurring in every sector, everywhere. Local scaleups will take over Latam, while creating a much better place for all.